Automate your goals with Recurring investments

Stop trying to time the market, and put time on your side instead

Set it and stay on track

Investing on a set schedule helps you to consistently build your portfolio for the long term

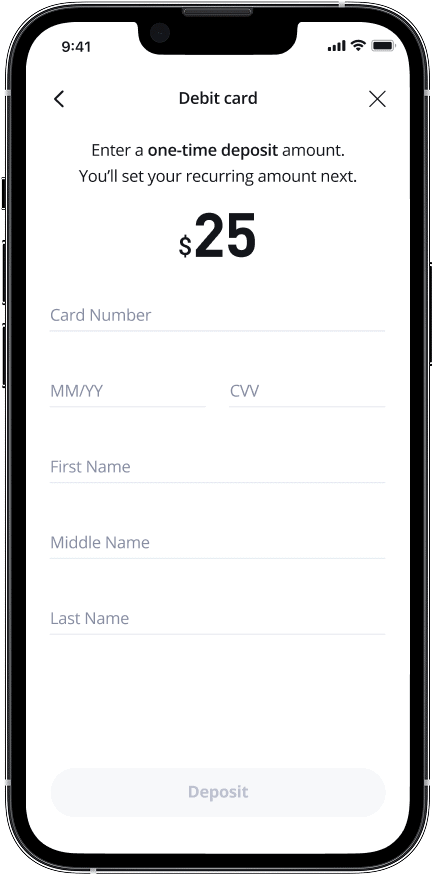

Low $25 minimum monthly investment to get started

Spread your investments over time to reduce risk

Enjoy reduced FX fees plus lower commissions on stocks and ETFs

Set it and stay in control

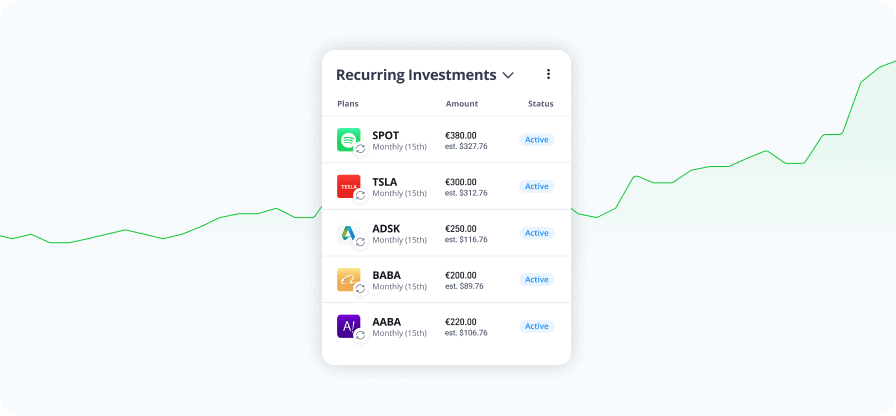

Choose from thousands of stocks, ETFs, and crypto for your recurring plans and manage them all in one place

Remove the stress of missed opportunities and impulsivity

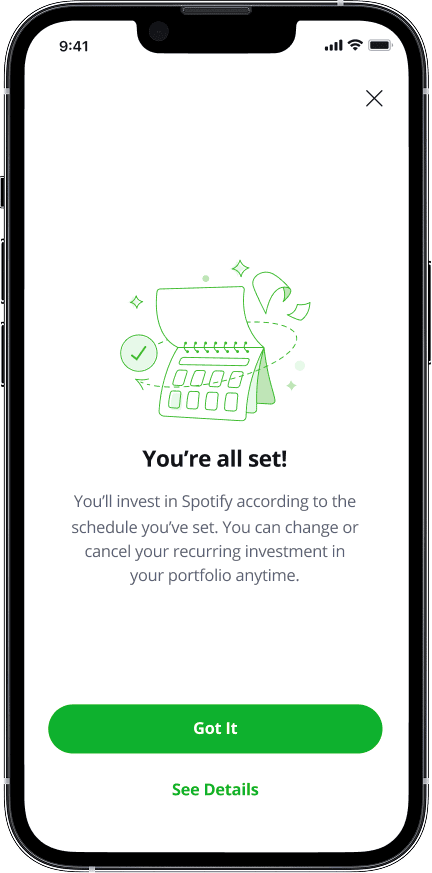

Adjust, pause, or cancel your recurring plans at any time

We’ll notify you when each automatic investment is executed

Set it with just 3 steps

A simpler way to help grow your portfolio

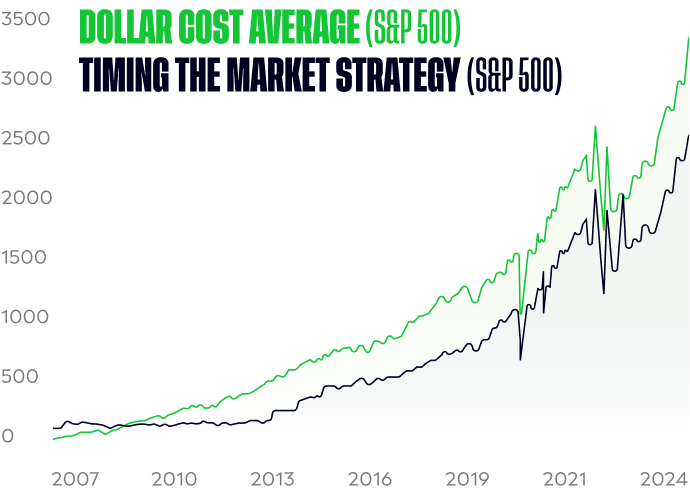

What happens when you invest consistently over time versus trying to predict the best times to buy or sell?

If an investment had been made in SPY whenever the S&P 500 index dropped by more than 5% (“buying the dip”), this would have resulted in 16 investments, compared to 210 months of consistent dollar-cost averaging – with the recurring investment strategy performing 125% better.

Hypothetical $1000 investment in SPDR S&P 500 (SPY) ETF (2007-2024)

Data as of December 1, 2024. For illustrative purposes only. This is not investment advice. Past performance is not an indication of future results.

FAQ

- What is a recurring investment?

-

A recurring investment, also known as a recurring order, allows you to set a fixed amount of money to invest regularly in an asset — often with the goal of growing your portfolio over time. You decide how much to invest and when, and then market orders are placed automatically according to the schedule you’ve set.

- How do I set up a recurring investment?

-

To set up a recurring monthly investment plan for the asset of your choice*:

- Go to the asset’s page on the platform and click “Get Started” on the recurring investment banner.

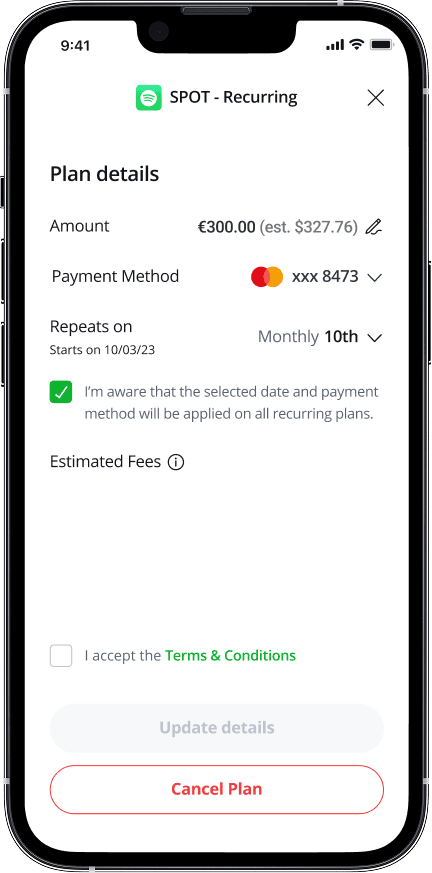

- Set your payment schedule by choosing the date on which your investment order will be executed each month.

- Choose the amount you wish to invest each month.

- Select your desired payment card to be used for the recurring investment. If you don’t have a connected card, you’ll be prompted to add one as the first step in setting up your recurring investment.

- Follow the on-screen directions to review and confirm your plan.

*Please note that recurring investments cannot be set up on CFDs, copy trades, Smart Portfolios, leveraged or inverse ETFs, and elevated risk stocks.

For more information, click here. - How do I fund a recurring investment?

-

Recurring investment orders will be funded by payment cards. When you set up a recurring investment on eToro, you will need to select a card to be used for recurring deposits. Clients of eToro (UK) Ltd can only use debit cards.

- In what assets can I set a recurring investment?

-

Recurring investment orders may be set for stocks, ETFs and cryptoassets.

Please note that recurring investments cannot be set up on CFDs, copy trades, Smart Portfolios, leveraged or inverse ETFs, and elevated risk stocks.

- At what frequency can you set a recurring investment?

-

Currently, a recurring investment can be set for once a month, on the date of your choice.

Recurring orders will always be executed on the scheduled date. If the market is closed on said date, it will execute on the next day the market is open.

- What fees are associated with recurring investments?

-

Stocks’ and ETFs’ positions opened through a recurring plan are exempt from paying a standard commission fee. However, the fee still applies when closing.

- How do I edit my recurring investment plan?

-

Currently, it’s not possible to edit existing recurring investment plans. To make changes, please cancel your current plan and set up a new one.

- How do I cancel my recurring investment plan?

-

To cancel a recurring investment plan:

- Go to “Portfolio”

- Select “Recurring Orders” from the drop-down menu

- Select the relevant recurring order plan

- Tap “edit” and ‘cancel